Depreciation spreadsheet example

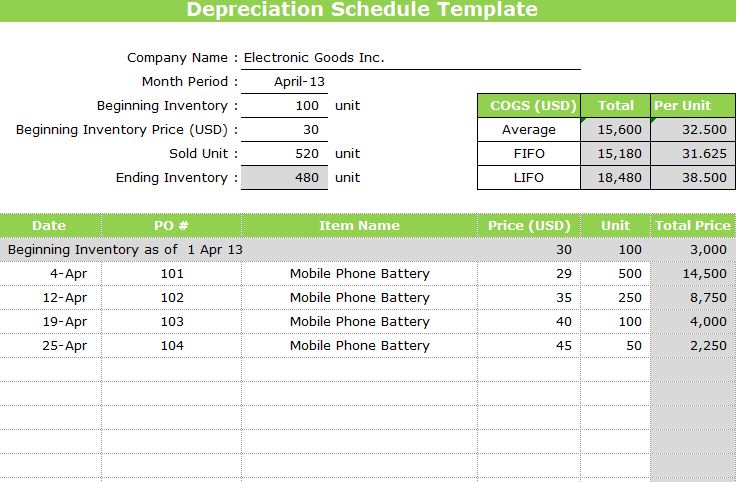

With an Excel inventory template like a fixed asset depreciation calculator warehouse inventory list physical inventory count sheet or home contents inventory list youll have greater control of your assets. A PL statement shows a companys revenue minus expenses for running the business such as rent cost of goods freight and payroll.

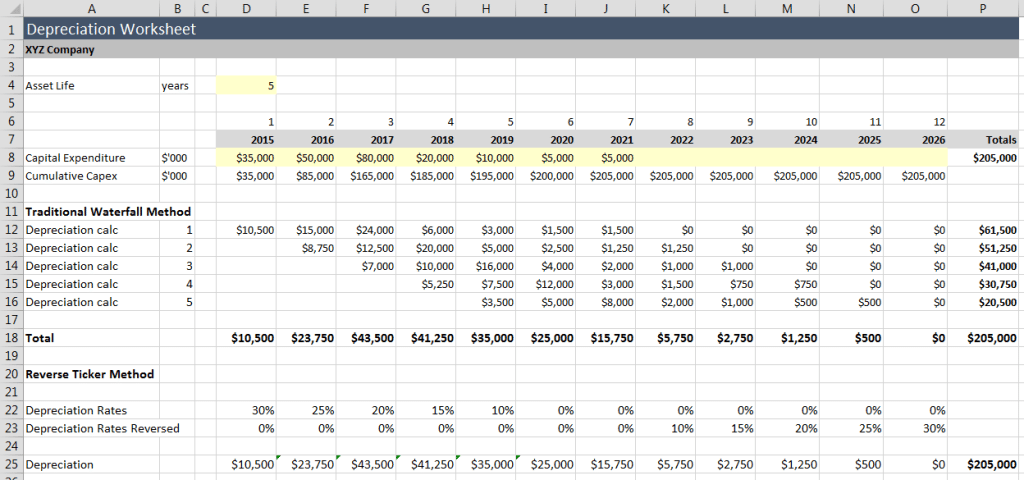

If You Re Not Modelling Depreciation Like This You Re Doing It The Hard Way Access Analytic

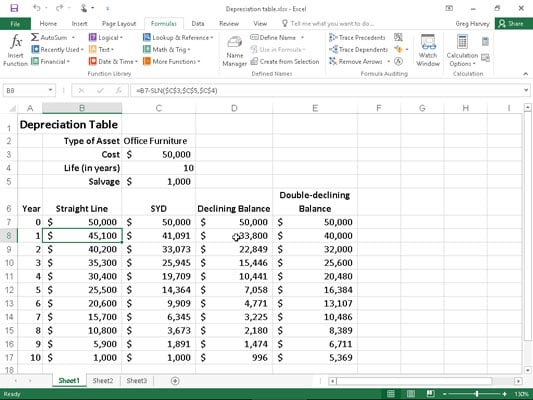

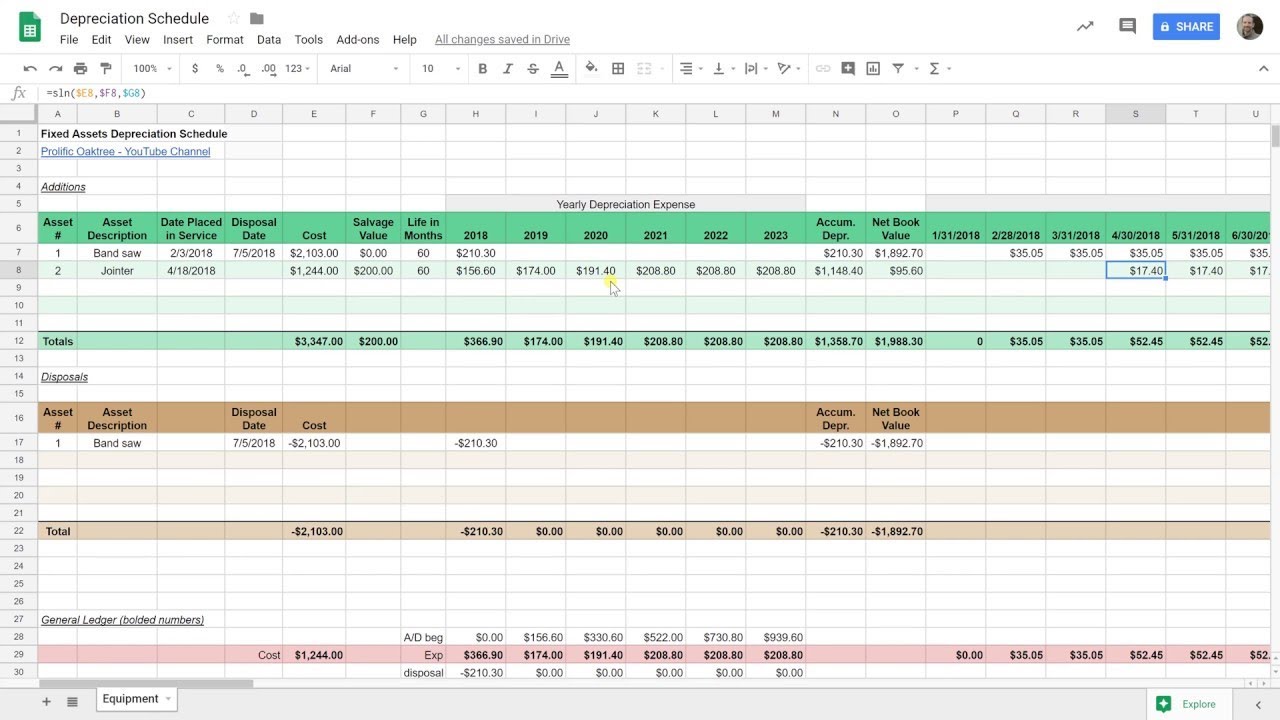

We need to define the cost salvage and life arguments for the SLN function.

. One of the most powerful things about this spreadsheet is the ability to choose different debt reduction strategies including the popular debt snowball paying the lowest balance first or the debt avalanche paying the highest-interest first. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. This is perhaps best illustrated through an example.

Along the top are column headers A through Z and beyond and along the left side are numbered row headers. The mode is Calculated Using the formula given below. Projected Income Statement Template Excel Google Sheet OpenOffice.

It takes 2 days to sell and 3 days for the client to transfer the payment. Sir I have downloaded cos act depreciation calculator 2018-19 while calculating in Additions sheet it is showing negative figures in dep for year 2018-19. The average car depreciation rate is 14.

For example hair saloon is a service business but it sells shampoos conditioners etc where it requires warehouse or inventory system to keep their stocks. In other words it indicates the change either in absolute terms or as. Suppose for example a business originally purchased an asset for 120000 and at the time decided to use the straight line method of depreciation with an estimated useful life of 10 years and salvage value of zero.

Typically it gives a description of the purchased items and. A pro-forma invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. The term Horizontal Analysis refers to the financial statement analysis in historical data from the income statement balance sheet and cash flow statement is compared with each other.

For example due to rapid technological advancements a straight line depreciation method may not be suitable for an asset such as a computer. Depreciation is wrongly added back to the purchase cost and it is showing wrong figures. On the other hand a.

The cost is listed in cell C2 50000. Another example is a food truck business it produces food to eat but also sell beverage from other companies. It is a mixed between a service and merchandising business.

Salvage is listed in cell C3 10000. The residual value of a fixed asset is an estimate of how much it will be worth at the end of its lease or at the end of its useful life. A computer would face larger depreciation expenses in its early useful life and smaller depreciation expenses in the later periods of its useful life due to the quick obsolescence of older technology.

At the end of the current month the balance reaches 10000. Just choose the strategy from a dropdown box after you. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along.

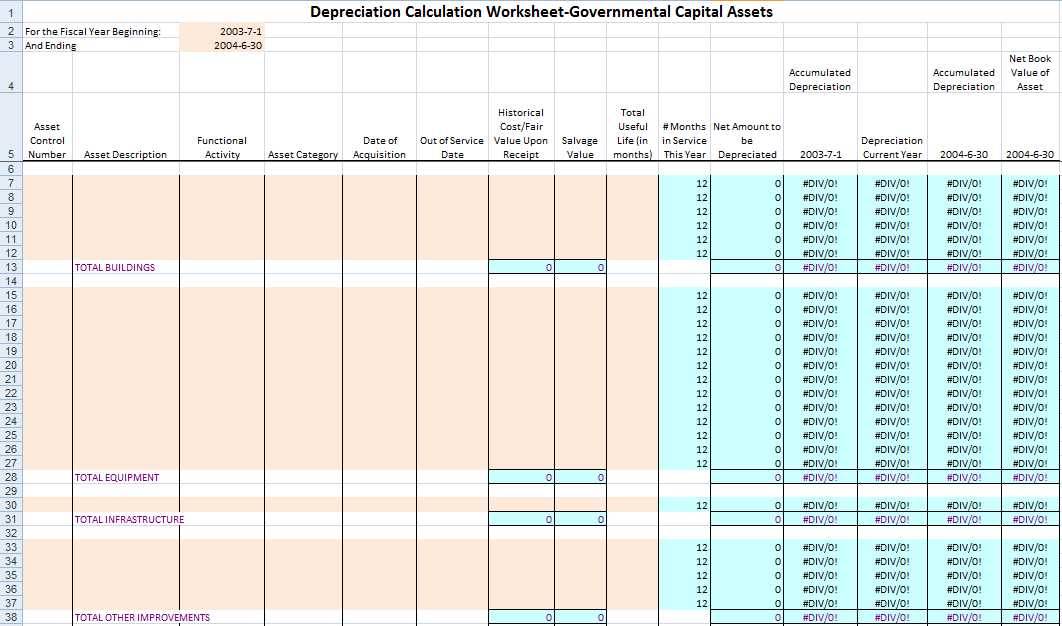

Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. By default the work area is a grid. The depreciation estimate when purchased is calculated as follows.

A P 1 - R100 n. This would mean that additional 5000 worth of debtors were not able to pay their dues which will decrease the cash available within the company. It is the most common method of spreading the assets value throughout its life.

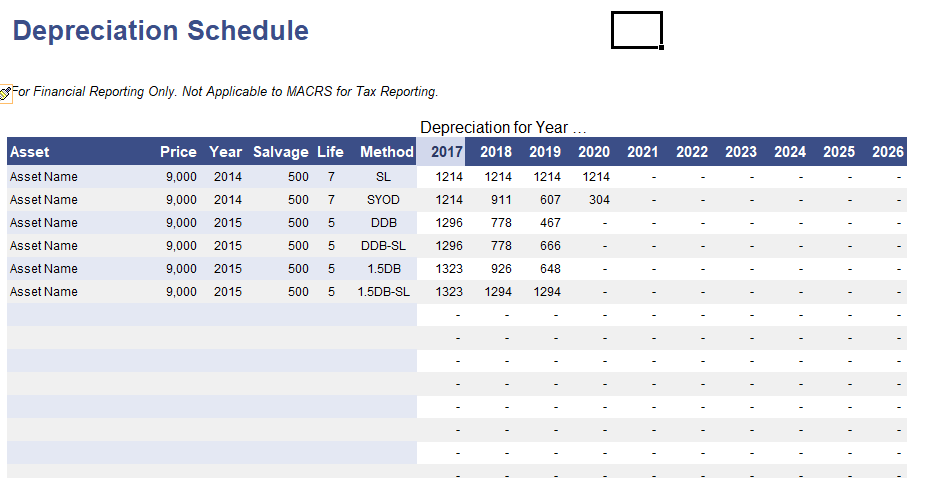

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. Then the lower frequency is of the modal group which is 4 in this case is taken as fm1 and fm-1 will become 7 in this example. These include SLN straight-line SYD sum-of-years digits DDB declining balance with the default being double-declining VDB declining balance with switch to straight-line DB fixed-declining balance AMORDEGRC and AMORLINC.

See the description of the. And we have fm that is the frequency as 8. Each rectangle in the spreadsheet is called a cell and they are each named according to their column letter and row number.

Each entry on a PL statement provides insight into the cash. The book value is what is reflected as the assets value on the balance sheet. Depreciation limits on business vehicles.

If you set the dividend payment frequency to 12 months and the payment option is set to Subsequent the dividend will be included on the income statement in the last month of the appropriate cash flow projection year and the dividend payable at the end of the financial year and all subsequent months in the new financial year until the. Excel uses a slightly different formula to calculate the deprecation value for the first and last period the last period represents an 11th year with only 3 months. There are a number of built-in functions for depreciation calculation in Excel.

Using the depreciation schedule example above the first item shows depreciation in the first 2 years of 5556 and 16667. Suppose that during the previous month your accounts receivable stood at 5000. The book value of an asset is calculated by deducting the accumulated depreciation from the original purchase price.

Horizontal Analysis Formula Table of Contents Formula. Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight-line method. Over time the depreciation of an asset will build up - the total depreciation over a period of time is known as accumulated depreciation.

Get 247 customer support help when you place a homework help service order with us. COGS depreciation utilities employee expenses rent etc. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

D P - A. For example It takes 1 week to Produce and pack Product A. Learn how you can save 100s or even 1000s of dollars.

The Car Depreciation Calculator uses the following formulae. For example the cell selected here is A3. I wont be discussing the last 3.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. On the one hand buying involves higher monthly costs but you own an assetyour vehiclein the end. Thus the transaction cycle is of approximately 2 weeks.

An inventory Excel template for your warehouse can give you specific information about both in-stock items and those on order. For example set this argument to 9 if you purchase your asset at the beginning of the second quarter in year 1 9 months to go in the first year. The choice between buying and leasing a car is often a tough call.

The lessor uses residual value as one of. What is the Horizontal Analysis Formula. The h is Called the Size of the class interval is 5 which we have considered as the starting interval as well.

Changes in Depreciation Estimate Example.

Depreciation In Excel Excel Tutorials Schedule Template Excel

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

How To Use The Excel Db Function Exceljet

How To Use Depreciation Functions In Excel 2016 Dummies

Depreciation Schedule Free Depreciation Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Asset Depreciation Schedule Worksheet Templates At Allbusinesstemplates Com

Depreciation Schedule Template Depreciation Schedule Excel

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

9 Free Depreciation Schedule Templates In Ms Word And Ms Excel

Depreciation Calculator Excel Template For Free Download

Depreciation Formula Examples With Excel Template

Depreciation Calculator

How To Prepare Depreciation Schedule In Excel Youtube

Depreciation Schedule Template For Straight Line And Declining Balance